Sustainability

Governance

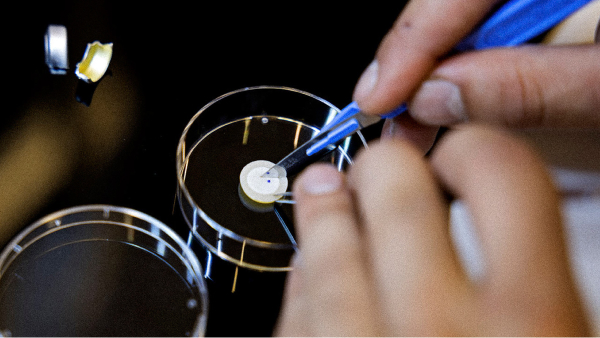

High quality, consistent and reliable cGMP manufactured Quats that enables better processes, minimize potential risks, and give you peace of mind.

At Novo Nordisk Pharmatech, we categorise governance into three dimensions. The first dimension is Corporate Governance which covers our ownership structure and governance. Governing Processes, the second dimension, refers to how we run our business. The last dimension, Sustainability Standards is about how we oversee and prioritise our sustainability and ESG agenda.

Ownership structure

We are 100% owned by Novo Nordisk A/S, which is a part of Novo Holdings A/S, a Danish company wholly owned by the Novo Nordisk Foundation. As a part of this foundation ownership Novo Nordisk Pharmatech A/S supports the objective of the Novo Nordisk Foundation of creating value for society.

Governing processes

We have a two-tier management structure consisting of the Board of Directors and Executive Management. The Board of Directors is responsible for the overall strategic direction, performance and strategy implementation. The Executive Management manages day-to-day operations, development and implementation of strategies and policies.

Sustainability standards

Environmental and social considerations are an integral part of our everyday work. To secure a high standard and continuously improve we are ISO 14001 and ISO 45001 certified. We report on our ESG performance in accordance with relevant disclosure frameworks and have an integrated reporting approach.

Risk management

Managing risk is central to Novo Nordisk Pharmatech, as it is critical for us to protect our assets, our employees, and our business. It is the responsibility of the management board to review the overall risk exposure of the company. For this purpose, a risk assessment process is in place, where relevant risks are identified and assessed on a frequent basis. Based on this assessment, mitigation plans are evaluated twice a year, and subsequently reported to the Board of Directors as a standard agenda item at Board meetings.

Risks are assessed based on the likelihood of events, as well as the potential impact of events on our business to reach short and long-term objectives. This assessment is anchored in the strategic planning process presented to and approved by the Board of Directors on an annual basis.

The top risks at Novo Nordisk Pharmatech are identified as:

1. Corruption and bribery

As Novo Nordisk Pharmatech operates in a global market, we also adhere to the highest standards of business ethics in our dealings with external parties. All relevant employees receive mandatory e -learning training, as well as training from legal experts to counter corruption and/or bribery attempts. Our operating model is to use distributors in global markets, and our distributors are trained and contractually obliged to uphold the same standards. If corruption and bribery attempts do happen, there is an established whistle-blower framework available, enabling anonymous reporting if deemed necessary

2. Health & Safety

Our production processes involve chemicals that are potentially hazardous to the health and safety of our employees as well as the local environment. Therefore, we are continuously investing to mitigate the risk of adverse situations in this area.

3. Environmental

We are continuously reviewing our environmental mitigation plans to ensure we are equipped to deal with abnormal climate situations such as the aftermath of flooding and heavy rain as we are situated close to sea level.

4. Commercial risks

As part of annual budgeting and follow-up, we forecast with expectations on market developments in the short- and long term. A long-term risk in the quats market is a trend away from using preservation chemicals in final products, as end customers are looking for alternatives to this. This can threaten the long-term growth of our quats business. For technical insulin, the market has developed insulin-free media that is used in certain applications and creates a long-term risk to our growth. Further risks for insulin include unsuccessful product executions in our large customers and patent expiration on mAb blockbuster drugs. These situations could result in the loss of substantial revenue in the short term. If some of our big insulin customers suffer in their product executions, and when patent expiration happens on mAb block buster drugs it will have a short-term financial effect as we could lose out on substantial revenues.

5. IT security

Disruption to IT systems, through cyber-attacks or infrastructure failure, can result in business disruption or breach of data confidentiality. Increased digitalisation of production and the way we collaborate – especially since the COVID-19 outbreak – increases the impact of a potential disruption to the IT systems, as it could limit our ability to produce and safeguard product quality as well as limit future business opportunities if proprietary information is lost.

To mitigate the IT security risks, there are built-in protection mechanisms in our IT systems, that are audited by internal audit for security controls, and campaigns are executed to ensure increased awareness in IT security for all employees.

6. Supply chain

Increased sales of our internal products have resulted in a high demand for raw materials leading to capacity constraints at our suppliers. Strong partnerships and long-term co-operation are key to securing a steady and sufficient supply. The latest increase in energy prices has resulted in increases in transportation prices and raw material prices. Having open discussions with suppliers and trying to find common understanding are helping to keep the costs at a reasonable level. However, it is inevitable that costs for raw materials will increase.

Explore more

Collaboration

A successful collaboration starts with understanding. Learn how we can help bring your next idea or innovation to life.

Valuechain

Novo Nordisk Pharmatech improves biopharmaceutical manufacturing by developing and supplying innovative products used in the manufacturing of biopharmaceuticals.